How can platform operators and streaming service providers who curate vast catalogues of content differentiate themselves in their quest to acquire and retain users?

I recently joined a panel to discuss the various fronts the battle for content and service aggregation is being fought on. We considered how platform operators and streaming service providers who curate vast catalogues of content can differentiate themselves in their quest to acquire and retain users.

With representatives from Elisa, one of the most important small/ medium payTV operators in Europe, SportsTribal, a new FAST platform devoted to sports from billiards to combat sports and Altman Solon, one of the world’s largest global strategy consulting firms, our session was faultlessly chaired by Videonet’s John Moulding. Well placed to comment on what is perhaps one of the most discussed topics facing the video service provider industry today, the panel examined a range of topics and themes.

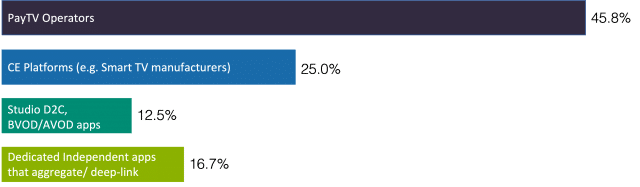

One of our first discussion points centered around how Consumer Electronic (CE) companies, and in particularly TV manufacturers, are rapidly becoming the gatekeepers through which consumers can access their favorite video services. But who is best placed to be the default content aggregation and discovery user-experience provider that consumers respond to again and again? During our panel, we asked our audience.

Who is best placed to be the default content aggregation and discovery UX that people return to again and again, every day (thinking about the time period 2023 – 2026)?

PayTV operators came out top. Perhaps this is not surprising given the benefits they provide in terms of a centralised, aggregated content offering alongside their long-honed skills of packaging content into bouquets or bundles that resonate with consumers. What was more surprising was the level of response for independent aggregators and the role they could play in aggregating streaming services or deep-linking to content.

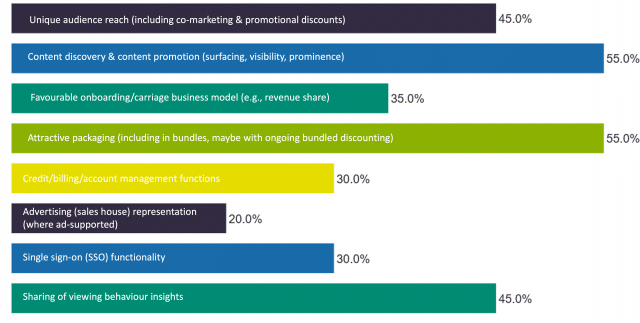

Our second poll focused on the most important value-additions a content aggregator could add to their proposition. As the panel discussed, content discovery and the value of subscriber behavior data both proved popular. Interestingly, the two that didn’t fare so well were around account management and the roll of single sign-on – tools which some see as key to enabling a fully aggregated solution that drives brand loyalty and provides subscribers with access to all their favorite streaming services without the need to keep changing apps.

Beyond ‘carriage’, what are the most important value-adds a content aggregator (e.g. PayTV operator/ e.g. CE device maker) can give to a streaming content service? You can choose up to four items from the list

With an increasing need to maximise subscriber value and provide services that are both revenue sustainable and brand relevant, today’s video service operators are launching offerings with aggregation at the core. NAGRA has been working with leading video service operators to realise such ambitions with examples including Starhub in Singapore and Claro in Colombia. Powered by the OpenTV Video Platform, NAGRA content aggregation solutions provide a fully integrated solution that better markets, monetises, and manages extensive content catalogues. Presented to subscribers through a range of device options that include Android TV set-top boxes, streaming sticks, Smart TVs and apps for multiple types of open devices, OpenTV Video Platform provides a single, consumer-focused solution that increases operational efficiency, promotion and data-driven decision-making opportunities.

Our content aggregation webinar is accessible in its entirety so why not catch-up today and hear from my fellow panelists about the challenges and opportunities content aggregation presents. If you’d like to discuss content aggregation, OpenTV Video Platform or how NAGRA can help realise your video streaming ambitions, why not have a no-obligation chat with one of experts; just get in touch – we’d love to continue the conversation!